Something changed

The most popular day of the year for financial fraud is 24th December. Everyone is in a rush to get payments out of the door and leave early. So if you slip in some urgent invoices, change bank details you have a chance. What’s more, nobody will be back until early January by which time our fraudsters have whisked your money to Brazil and your bank has no chance of reclaiming it.

It’s a good day for politicians too, lots of horror announcements are made on the 24th because nobody is watching. Then, weeks of quiet. Christmas, New Year.

This year I felt as though something profound changed over that period. The AI labs dropped some major releases just before Christmas. The reason being that usage drops and they can test their new toys without overloading servers etc. Claude Code for example upped usage by 2x between Christmas and New Year. What happened was an explosion of activity. It became obvious to anyone using them every day that the new models were in a different league to everything that had gone before. They can quite literally build and deploy entire websites in minutes (complex ones not just landing pages). It is the agentic capability of the new model that is the most impactful, it can work for hours on problems.

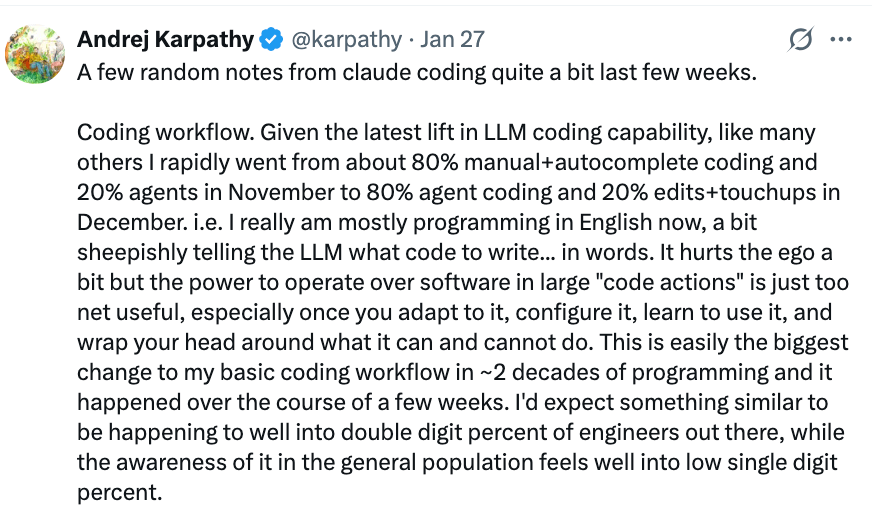

Andrej Karpathy coded Tesla’s self-driving cars. Here’s what he thinks.

Almost nobody is in this guy’s league as far as programming is concerned. Yet, he cannot compete with the machines and just leverages them. He went on to point out that rather than code less, he now codes more. In the past it would not be worth the effort to automate some things because of time and cost, but now that time and cost is almost zero, everything can be coded.

Perhaps most significantly amongst the Anthropic releases of the last few weeks was the revelation that they were almost entirely written by Claude itself.

What of it though? Well it’s up and to the right. There are people using swarms of agents now to build websites, do SEO, marketing. But Karpathy is correct “awareness in the general population feels well into low single digit percent”.

One of the highest paid jobs of the last 20 years basically went to zero and almost nobody noticed. Of course it will take time to filter through and nobody is firing their best engineers because they are actually best positioned to understand how to exploit the new toys. Employing new people though; maybe not.

You have one task for 2026. Launch a simple website with Claude Code. Add bitcoin payments to it with BTC Pay Server. The first one will take you a month. The second one a week., then an hour, then 10 minutes. It’s nuts, but you can ride the exponent yourself and have a fully financially operational website which runs at zero cost (even hosting is free on Cloudflare and payments are free with BTC Pay Server).

The weirdest bit though was the shift happened over the break while nobody was looking. A seismic shift under the cover of the holidays. I felt something changed, but let’s see.

Confidence

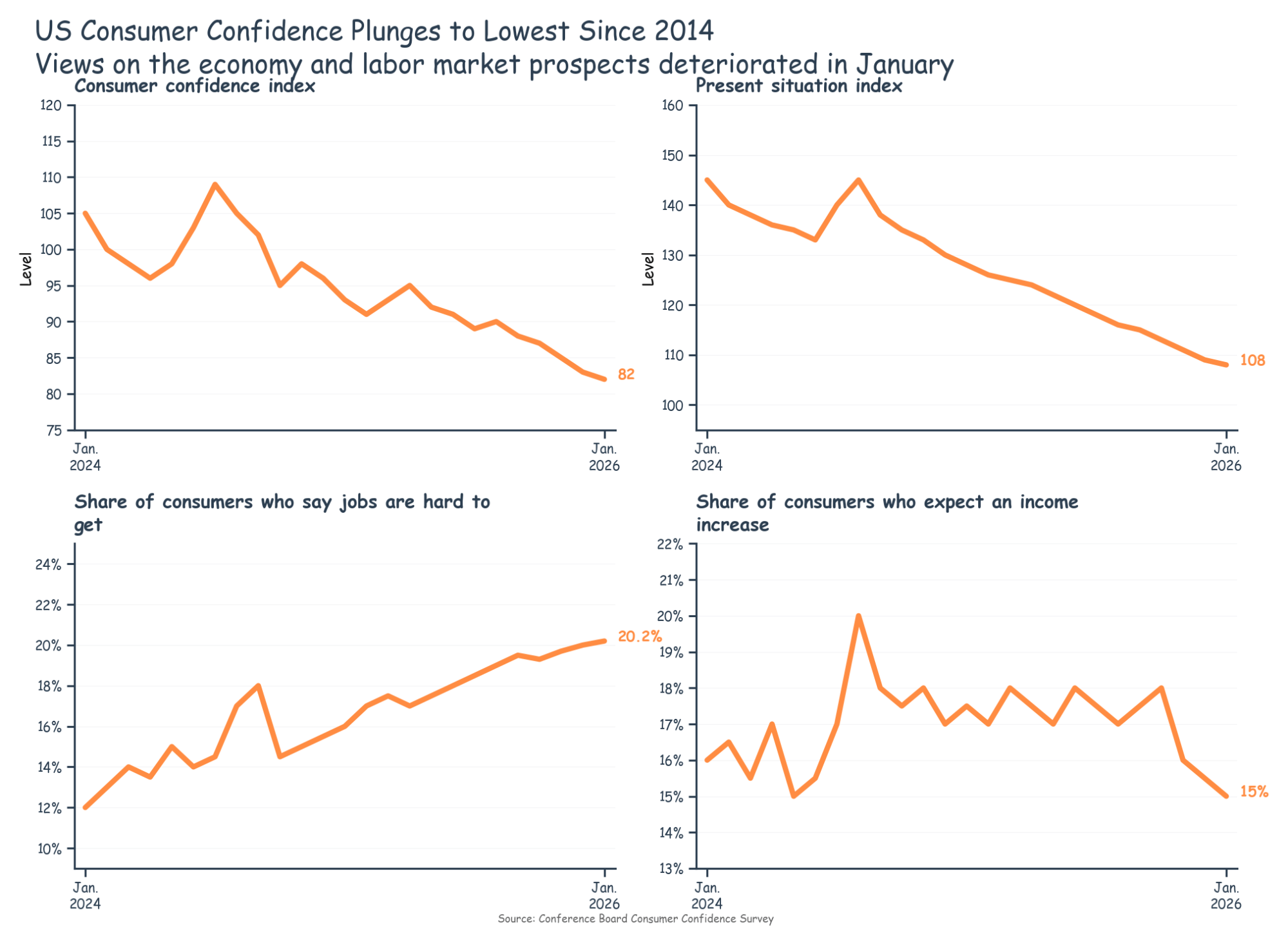

Despite the low awareness levels, something is moving through to the labour market. Not so much that employment is an issue but certainly getting a payrise is. Only 15% of Americans are expecting an income increase this year.

On the face of it the US economy isn’t having any difficulty at all. 5% growth in Q4 is like them adding an entire Australian economy. The issue appears to be that the gains are all going to a small group.

It’s really hard to compute, but labour isn’t a thing anymore. The one thing standing in the way is robotics and that transformation of AI into the physical world is going to take longer.

Two pieces on that theme. The first from Hamish Douglass who predicts an employment ice-age with 15%-30% unemployment. Then this on who the winners in the new world order are likely to be. In short it is likely better now to employ one person who knows deeply how to use agentic AI, they can do the work of 10 people. Even if you pay them $1m, it’s still better than 10 people on $100k doing it themselves.

Maybe there will be an employment ice-age but if in fact you can coordinate 100,000 agents by the end of the year I predict you will be a very valuable person. Simply adopt the tech, immerse yourself in it and you will be a winner.

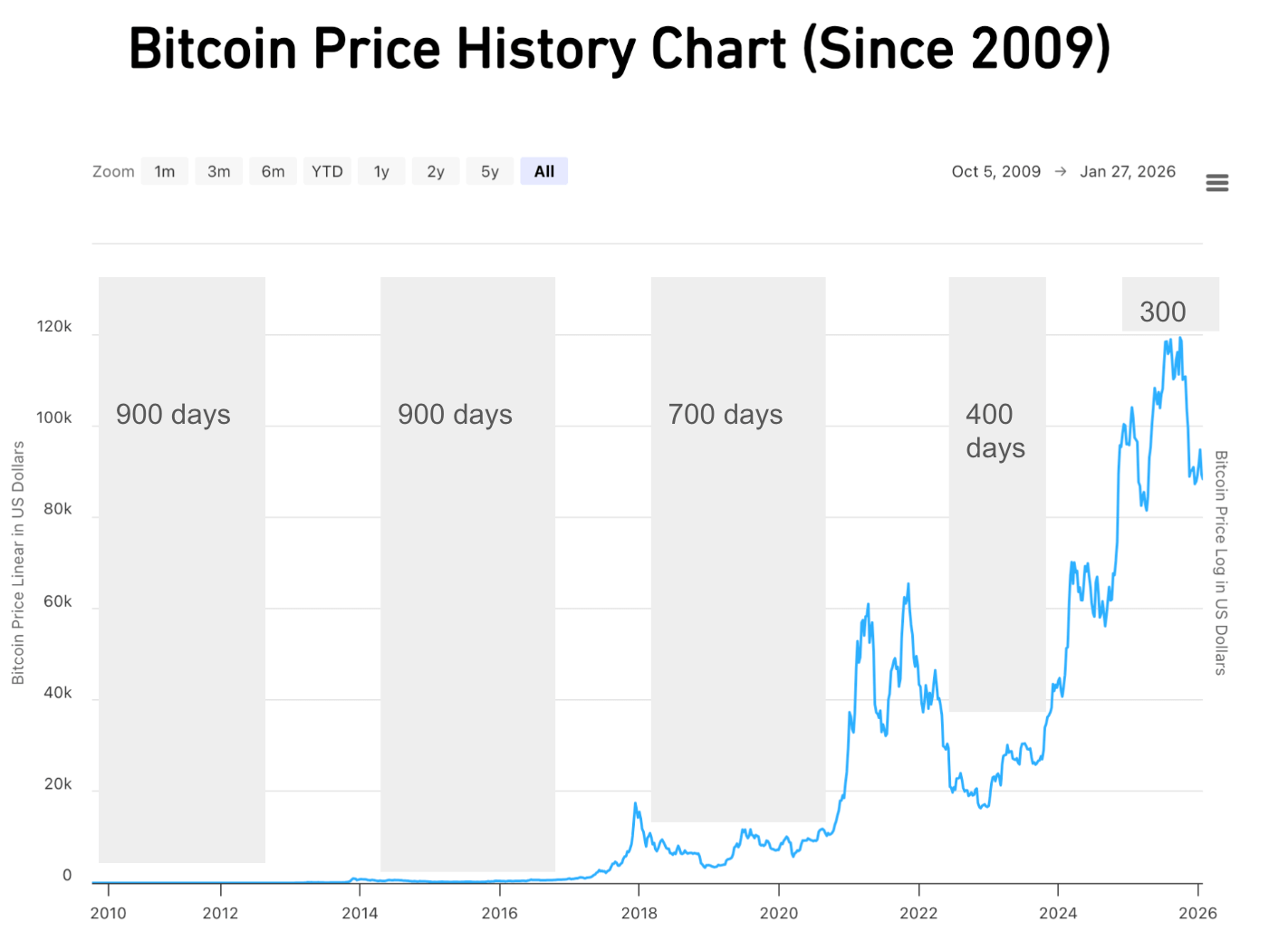

Why is bitcoin not doing anything?

Long periods of boring consolidation are actually a feature. Bitcoin generally front runs the market, as it did prior to the last US election. It even does so on weekends. The general direction on Saturday and Sunday is often a precursor to the equity market opening movements.

If I were to make an estimate of how much longer the boredom will continue it would be another six months. At that point we are 18 months out from the next bitcoin halving and believe it or not, all eyes will be on 2028. Anyway, expect a few obituaries over the next few months. We can add them to the list.

Cheat

Australia’s inflation problem has returned. Economists are aligned on ‘government spending’ being the issue or immigration pushing up the cost of everything. Maybe.

Historically, governments have fought inflation simply by cheating. We covered this a year or so ago in ‘The Theft of Progress’. Essentially we get better at everything because of technology, so prices are always falling (believe it or not, but they are). This trend basically covers up the government’s incompetence, which causes prices to rise. For it to work though, you have to actually adopt technology at a higher rate than your incompetence. If you just ignore it then you get an inflation problem. We have many examples in Australia

-

Energy: we are adopting very old technology. For a country that is the Saudi Arabia of gas, why are we importing so many wind turbines and littering the countryside with them? That technology is from 1500 and will not lower prices.

-

Self Driving Cars: Australia is perfect for these. It’s a very simple road network and generally employs traffic lights not roundabouts making it even more suitable. The problem of self driving is solved. Why don’t we have it? The present arrangement is this:

South Australia, New South Wales, the ACT and Tasmania said they had allowed the introduction of the technology, provided the driver — who remains legally responsible for the car — maintains supervision and control. A spokesperson for Western Australia’s Transport Department said drivers were required to keep both hands on the steering wheel when using FSD, while Queensland’s transport department requires only one.

That is exactly how Australia does it. You need both hands on the wheel in WA and only one hand in Queensland? How does that help? What is happening North of the Tweed that means they only need to use one hand when zero hands are required. As for everyone else they need to use two?

In the US insurance companies are halving premiums for self-driving cars because they are so much safer, demonstrably so. The number one danger to the public (children in particular), the road, could be so much better and so much cheaper. The technology is literally begging to be used and we protected our children with a social media ban rather than stopping them getting hit by cars?

-

Payments: everyone loves OSKO. Instant payments are now 95% deployed. China has had it for 10+ years. Same in the UK (Faster Payments) and Europe (SEPA). Australia was very slow.

The list just goes on and on, including housing regulations and planning regulations all of which serve to slow down the adoption of technology.

Government spending is not the issue. The speed of adoption of technology is. My advice to Dr Chalmers (which he hasn’t asked for) is to cheat like governments always have. Cheat hard, introduce technology at warp speed. Watch the cost of things drop through the floor, claim credit, become Prime Minister. You’re welcome.

Japan

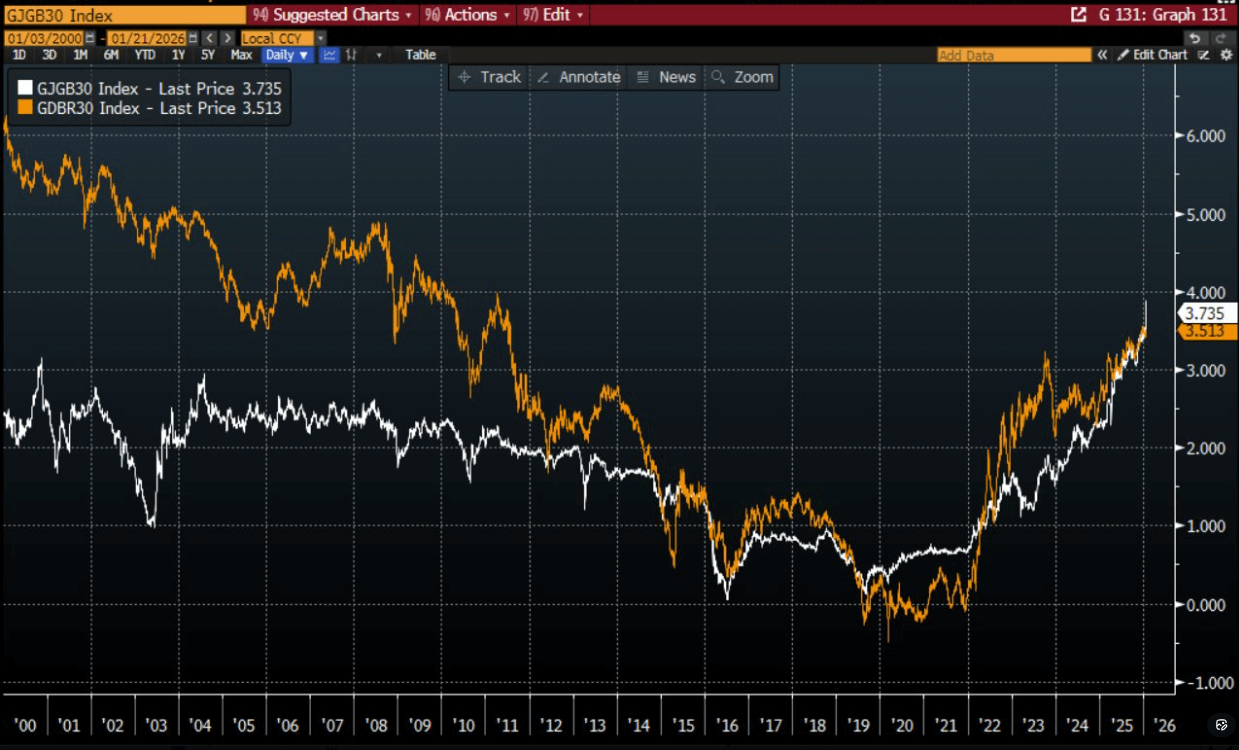

After lying dormant for years, Japanese bond yields have absolutely exploded recently. The 30 year yield now sits just below 4%, slightly higher than Germany’s.

Japan’s debt to GDP ratio is 240% compared to Germany’s 65%. There is absolutely no doubt that Germany can afford its debt load, probably for the next 30 years. Japan? Not so much, collapsing population, spiralling debt, how is it possible their borrowing rate is the same?

The answer is quite simple. In 2013 the Bank of Japan owned 13% of government debt. Now they own 55% of it. More specifically though they began tapering those purchases in 2024 but only for JBGs with a maturity of 10 years and under, they continue buying long dated bonds but don’t disclose holdings by maturity. So it is entirely possible that the Japanese central bank now owns over 70% of those long bonds, it could be more.

We know how this is all done too. They simply print the money and who cares? We have talked about this for years and Japan is still Japan. Whatever they have done to their collapsing bond market has worked, most western nations are going to follow their lead.

Sure the Yen is down 30% in 10 years against the dollar, it will likely drop further. That is the path for all indebted sovereign nations. Their pensioners will gradually go on fewer foreign holidays, they will see the doctor after a slightly longer delay than before. They will be poorer. People also seem to understand and accept this, hence the race to acquire hard assets.

Euro-Trash

A big SWOT analysis! I can hardly wait for the output of that, if history is a guide it should be ready in 2035.

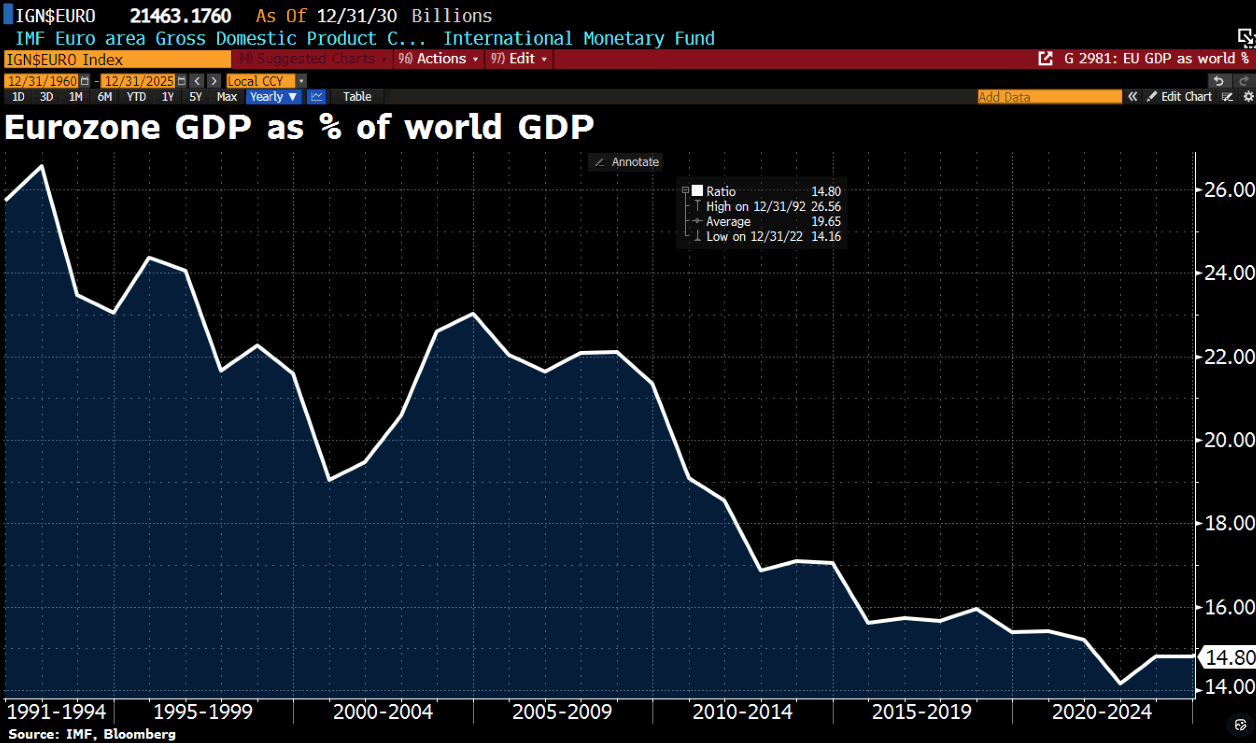

One of the things I would include would be this chart.

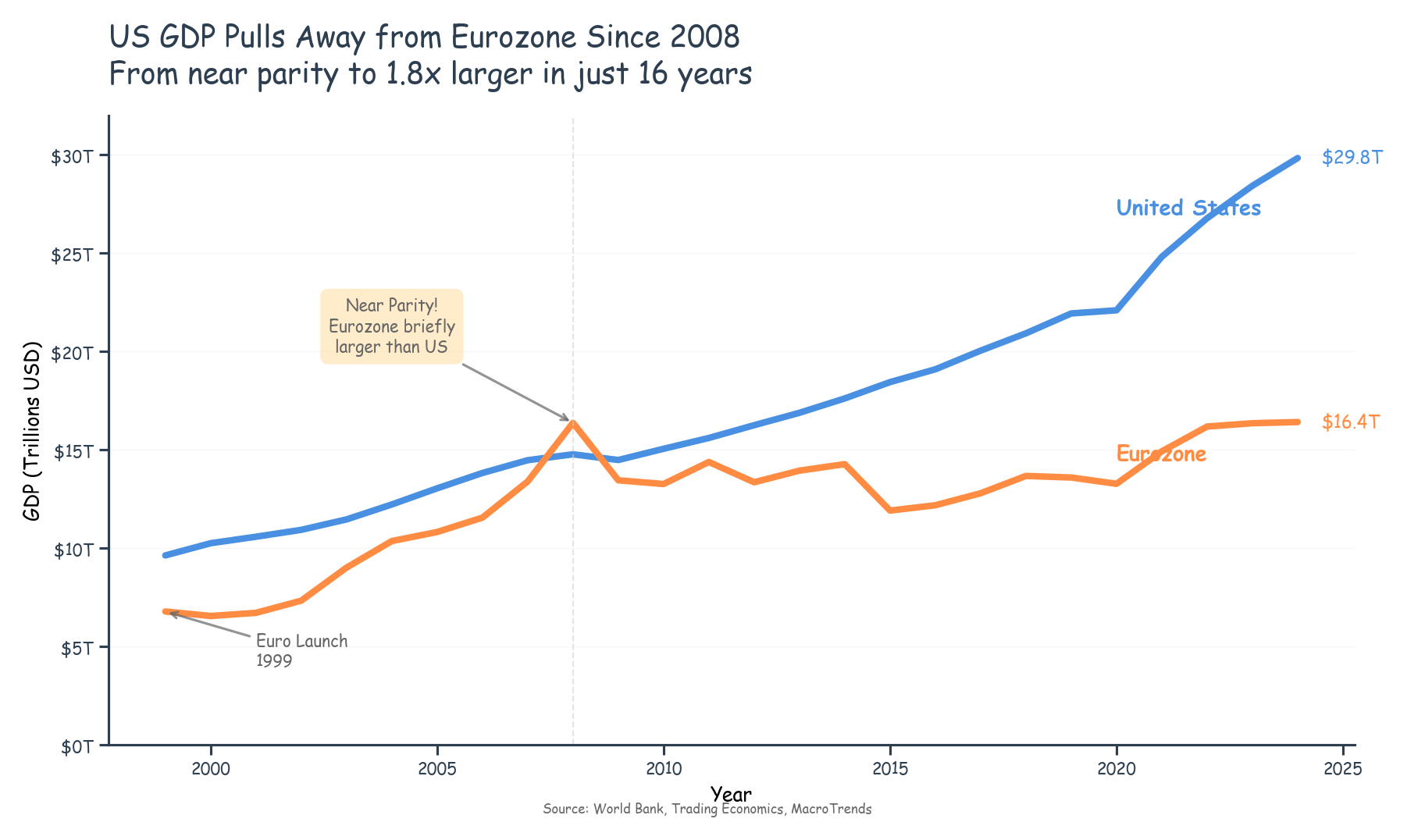

The EU economy was larger than the US in 2008, then something happened from which Europe would not recover. The US economy will likely be twice the size of the EU in the next 24 months. You really have to look at that and wonder what happened, will a SWOT analysis really cut it.

Europe is precisely as wealthy as it was 20 years ago, which is alarming when you consider that the GDP figures probably vastly underestimate the impact of inflation. A reasonable estimate would be that the majority of people are in fact poorer than they were in 2008.

One of the things Europe will have to do if it is to restore its independence is wean itself of the American tech stack. France started the process this week announcing its intention to replace Zoom, Google Meet, Microsoft Teams, and other videoconferencing software in its civil service. The “sovereign solution” will be ready by 2027. I suspect that will not be that easy because those companies have been refining their software for decades. How good will Le Zoome actually be?

Until Le Zoome takes off then, European relevance on the global stage continues to drop. Once a quarter of the world’s economy, now roughly half that.